It’s the perfect time of year to understand how donating to charity will benefit you in your tax return.

By Alex Roberts

With our new tax deadlines looming just around the corner, it’s a great time to understand how donating to charities such as the Women’s Centre of Calgary helps you pay less in taxes at the end of the year.

Canada has relatively generous policies for tax credits on charitable donations, though exactly how much of your donations are tax deductible depends on the amount as well as your income and provincial regulations.

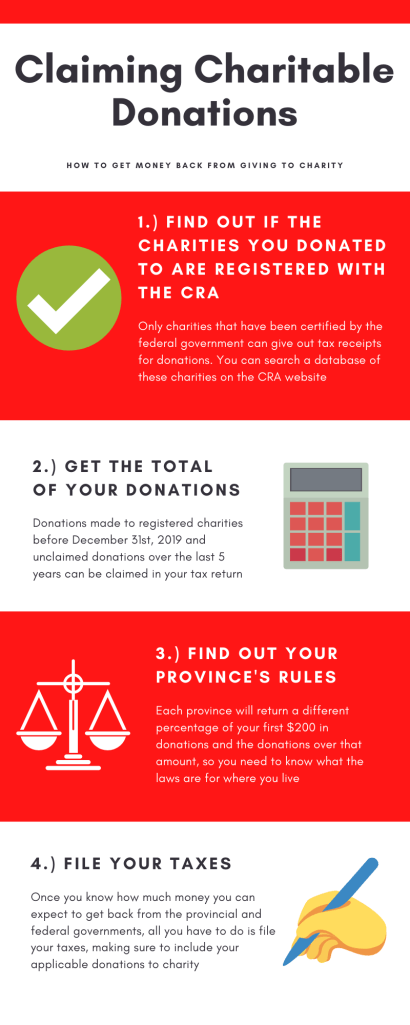

The first step in claiming your tax deduction is making sure that the organization you donated too has the authority to issue you an official donation receipt, since only some charities have the federal government’s permission to do so. The Women’s Centre of Calgary is one of them, and to find out which other organizations qualify, you can search the Government of Canada’s database of certified charities here.

You then need to know how much you have donated. Donations before December 31st 2019 will count for your upcoming tax filing, as well as any unclaimed donations over the last 5 years. Each province as well as the federal government has a percentage of donations under $200 that can be redeemed, and a different percentage for the sum of donations over $200. For the federal credit, you can claim 15% of your first $200 of donations and 29% of the money over that amount. This means that if you donate $300, your federal tax credit would be 15% of the first $200, so $30, plus 29% of the $100 over that, so $29, giving you a total of $59 dollars in credit.

On top of the federal credit amount, however, you can also claim an amount provincially, though each province has its own laws on how much of your donations under and over the $200 line can be redeemed. In Alberta, you can receive 15% of your first $200 and 21% of donations after that (TaxTips, 2019). So for the $300 example donation given above, you would also receive $30 on the first $200, and $21 on the last $100. This brings your provincial total to $51, which you would then add to your federal credit for the total amount that you would receive in credit for 2019: 59 + 51 = $110.

For more information on taxes and charitable tax credits, you can check out the Canada Revenue Agency’s website here.

There are also great online resources to help you navigate the process of claiming donations, such as TurboTax Canada’s article on tax benefits of charitable donations and this table on TaxTips.ca that displays the provincial rates for charitable tax credits in 2019.

References

Canada Revenue Agency. (2017, April 27). Which organizations can issue official donation receipts? Retrieved April 2, 2020 from https://www.canada.ca/en/revenue-agency/services/charities-giving/giving-charity-information-donors/making-a-donation/which-organizations-issue-official-donation-receipts.html

Canada Revenue Agency. (2020, February 25). Claiming charitable tax credits. Retrieved April 2, 2020 from https://www.canada.ca/en/revenue-agency/services/charities-giving/giving-charity-information-donors/claiming-charitable-tax-credits.html

Moreharmony. (n.d.). Calculator on accounting workspace. [Photograph]. Canva.com. https://www.canva.com/photos/MADQ4mvYcmw-calculator-on-accounting-workspace/

TaxTips.ca. (2019, September 21). 2019 donation tax credit rates. Retrieved April 4, 2020 from https://www.taxtips.ca/filing/donations/tax-credit-rates-2019.htm

TurboTax Canada. (2019, October 3). Tax benefits of charitable donations. Retrieved April 4, 2020 from https://turbotax.intuit.ca/tips/tax-benefits-of-charitable-donations-5414